By Brian French

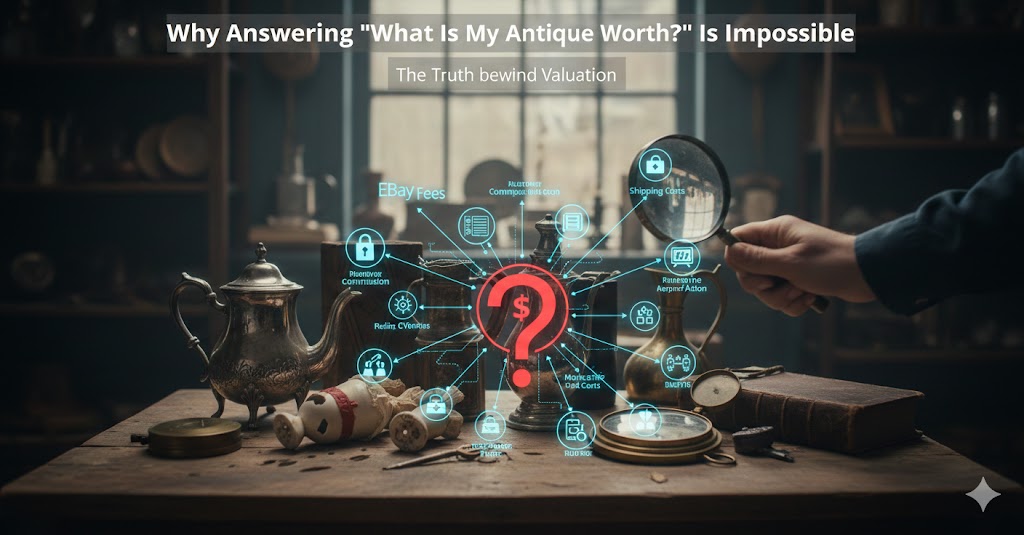

It sounds like such a straightforward question: “I have this item, you’re an antique dealer, tell me what my antique is worth.” But anyone who has actually tried to sell an antique or collectible knows the answer is far more complicated than a simple dollar figure.

The truth is, asking what something is worth is asking the wrong question entirely.

The Hidden Costs Nobody Talks About

When most people ask about value, they’re thinking about retail prices they’ve seen online or at antique shops. What they’re not considering is the enormous gap between what something sells for and what you actually walk away with after expenses.

Let’s start with the most obvious platform: eBay. Yes, you can reach millions of potential buyers, but eBay takes its cut—typically around 12-15% in fees. Then there’s the payment processing fee, another 3% or so. Right off the bat, you’re down nearly 20% from your selling price.

But it doesn’t stop there.

If you’re a new seller without an established reputation, buyers are inherently skeptical. You’ll get lower bids, more lowball offers, and less trust than an established dealer would command for the exact same item. Your lack of selling history becomes a hidden tax on your final price.

Then there’s your time. Who’s creating the listing? Who’s taking the photographs, writing the description, researching comparable sales, answering buyer questions, packaging the item, and dealing with shipping? Time is money, and if you’re doing this work yourself, that’s value you need to deduct from whatever you think the item is worth.

The Auction House Reality

Maybe you’re thinking, “I’ll just take it to a prestigious auction house.” Good luck with that.

First, most auction houses won’t give you the time of day unless your item meets their minimum value threshold—often several thousand dollars. If they do accept your piece, expect to pay around 30% in seller’s fees, sometimes more.

And here’s the kicker: auction houses typically start bidding at 25-30% below recent comparable sales. They do this to generate bidding momentum and ensure the item sells. It’s good business for them, but it means you’re starting in a hole.

Do the math: a 30% starting discount plus a 30% commission means you could easily net 50% or less of what you thought your item was “worth” based on previous sales records.

The Retail Price Fantasy

Perhaps you’ve seen your item for sale in an antique shop at a certain price and you’re thinking, “That’s what mine is worth!” Not quite.

That retail price belongs to a dealer who pays thousands of dollars a month for storefront rent, who has spent years building a reputation, who has cultivated relationships with collectors, who offers guarantees of authenticity, and who provides the convenience and trust that commands premium prices.

You, walking in off the street with an item you want to sell? You don’t get retail prices. You never have, and you never will.

The Time Value Problem

Let’s say you decide to “hold out” for the right price. Maybe you list your item at what you consider its true value and wait for the perfect buyer.

You might be waiting a very long time.

Antiques and collectibles are not liquid assets. The market for any given item can be incredibly thin—there might only be a handful of serious buyers in the entire world at any given moment. If you’re not willing to accept market price today, you might own that item for years before someone comes along willing to pay your asking price.

And what will it be worth in two or four years? That’s even more impossible to predict. Tastes change, markets shift, and the hot collectible of today can become the unwanted relic of tomorrow.

So What’s the Real Answer?

The bottom line is this: your item is worth whatever someone on eBay is willing to pay for it in a seven or ten-day auction, minus selling fees, minus payment processing, minus the value of your time to create the listing and handle the sale, minus shipping costs and materials, and accounting for your lack of selling reputation.

That’s the harsh economic reality.

Which is why the only honest answer an antique dealer can give you when you ask “What is this worth?” is a polite, sincere, and truthful: “I don’t know.”

Not because they’re being evasive, but because the question itself is unanswerable. Worth is not an inherent property of an object—it’s the intersection of dozens of variables including timing, platform, presentation, reputation, buyer psychology, market conditions, and pure luck.

The better question might be: “What would you pay for this right now?” At least that question has a definite answer, even if it’s not the one you want to hear.