Amazon’s Unbreakable Empire: Why No Competitor Can Catch Up

Amazon isn’t just winning—it’s building a commercial fortress so sophisticated that competition may soon become impossible. The convergence of AI, AWS infrastructure, and same-day delivery is creating a self-reinforcing juggernaut that grows stronger with every transaction.

The AI-AWS Money Machine

AWS generates roughly $90 billion annually, providing a war chest that competitors simply don’t have. But the real advantage is subtler and more devastating: Amazon uses AWS infrastructure to process petabytes of shopping data daily, creating AI models that predict what you’ll buy before you know you want it.

Traditional retailers buy cloud services from Amazon, Microsoft, or Google. Amazon owns the infrastructure, trains AI on its own data, and uses those insights to crush the very retailers paying for its services. It’s like playing poker against someone who can see your cards and owns the casino.

Every search, click, and purchase makes Amazon’s AI smarter. Walmart can’t replicate this. Target can’t either. They lack the data volume, the technical talent, and the infrastructure. Amazon’s flywheel spins faster every quarter while competitors stumble trying to build basic e-commerce capabilities.

Same-Day Delivery as Economic Warfare

Amazon now operates over 500 fulfillment centers globally, with hundreds of delivery stations positioned to reach dense urban populations within hours. This infrastructure—representing over $100 billion in investment—creates a time-based competitive advantage that legacy retailers cannot match.

The economics are brutal. When Amazon delivers within two hours, physical stores become obsolete for most purchases. Why drive, park, search aisles, and wait in line when items arrive at your door before lunch?

Amazon’s delivery costs decrease with scale. Each additional customer in an area makes every delivery cheaper. Each new fulfillment center increases the population reachable within hours. Marginal cost approaches zero.

Traditional retailers face the opposite trap. Their stores cost the same whether serving ten customers or ten thousand. Every square foot of retail space bleeds fixed costs. Prime real estate gets more expensive, not cheaper, as competition intensifies.

Walmart’s strategy of using stores as fulfillment centers is failing. Stores designed for browsing can’t compete with purpose-built logistics facilities. Retail workers aren’t trained for rapid fulfillment. Trying to serve both walk-in customers and online orders simultaneously creates chaos. Amazon faces none of these conflicts.

The Triple Lock-In Strategy

Amazon traps customers, merchants, and enterprises simultaneously.

Prime members spend twice what non-members spend and default to Amazon before considering alternatives. Once you’re paying for Prime—with its video, music, reading, and free shipping—the psychological switching cost becomes massive. You’ve already paid. Why look elsewhere?

Third-party sellers have no choice. Sixty percent of Amazon’s retail volume comes from merchants paying hefty fees for access to customers. These sellers feed Amazon’s algorithms, provide demand data, and train the AI that will eventually compete against them. Fulfillment by Amazon deepens the trap—merchants surrender inventory control and customer relationships for access to Prime shipping.

Enterprises building on AWS face architectural lock-in. Migrating from Lambda, DynamoDB, and SageMaker requires complete redesign, costing millions and risking catastrophic failure. Companies realize too late they’ve built their entire technical foundation on a competitor’s infrastructure.

Alexa: The Invisible Hand

Hundreds of millions of Alexa devices sit in homes worldwide, fundamentally changing purchase behavior. Voice ordering collapses comparison shopping. Customers accept Alexa’s suggestions rather than researching alternatives. The visual comparison that happens on websites or in stores simply disappears.

As AI improves, voice interfaces will handle complex purchasing decisions autonomously. Customers will delegate entire shopping categories to assistants that optimize for their preferences. Amazon controls both the assistant and the fulfillment network—a privilege competitors cannot challenge.

The Compounding Advantage

Here’s why Amazon becomes unstoppable:

More customers attract more sellers. More sellers increase selection. Better selection attracts more customers. Higher volume justifies more fulfillment centers. More centers enable faster delivery. Faster delivery increases Prime value. More Prime members generate predictable revenue. Predictable revenue funds AWS expansion. AWS revenue subsidizes retail pricing. Retail generates data. Data improves AI. Better AI optimizes everything.

Each advantage strengthens the others. Competitors would need to replicate the entire system simultaneously—mastering logistics, cloud computing, AI, hardware, content production, and marketplace management at once. Impossible.

Walmart has spent billions on e-commerce and still finds itself perpetually behind. Macy’s, Kohl’s, and JCPenney lack the capital, talent, and technical sophistication to compete on even a single dimension.

Top Florida News:

• Finding Purpose in an Empty Nest Christmas

• Florida News Websites to grow a Orlando Business

• Florida Website Marketing Launches Tailored AI Chat Bot Service

• Brian French Florida’s Top AEO Consultant

• 10 Tips on Buying Home Insurance in Florida

Global Domination Through Patient Capital

Amazon’s international expansion follows a brutal pattern: use AWS profits to sustain years of losses while building market share and infrastructure. Local competitors must generate profits to survive. Amazon can bleed cash indefinitely, knowing dominance eventually turns economics favorable.

In India, Amazon invested over $6 billion building infrastructure and negotiating with merchants. In Europe, cross-border logistics serve multiple countries from centralized networks. Competitors face a war of financial attrition they cannot win.

The Regulatory Wild Card

Only government intervention might slow Amazon’s march. Antitrust authorities are scrutinizing its dual role as marketplace operator and competitor, its use of seller data for private label products, and Prime’s bundling strategy.

But Amazon has become infrastructure. It employs 1.5 million people globally. Small businesses depend on its marketplace. Government agencies run on AWS. Breaking it up risks economic disruption that politicians fear. And Amazon’s integration creates genuine consumer benefits—lower prices, faster delivery, greater convenience—that regulators struggle to dismiss.

The Endgame

Amazon’s trajectory points toward something unprecedented: becoming indistinguishable from commerce itself. Its logistics network becomes the circulatory system for physical goods. Its cloud services become the computational foundation for digital services. Its AI becomes the intelligence automating transactions.

Traditional retailers no longer ask “How do we compete?” They ask “How do we survive?” The uncomfortable answer: find niches where experience matters more than convenience, where tactile interaction drives decisions, where local relationships create barriers, or where regulation limits Amazon’s reach.

The moat Amazon is building isn’t a defensive barrier. It’s a complex system of compounding advantages spanning technology, logistics, data, and capital that deepen over time. Each dimension makes others more valuable. Together, they create a position that may prove genuinely unassailable.

The future Amazon envisions is one where competition doesn’t just become difficult—it becomes structurally impossible. When a company controls the infrastructure of daily life, alternatives don’t just become unlikely. They become unimaginable.

That’s not a competitive advantage. That’s total economic dominance. And Amazon is closer to achieving it than most people realize.

Answer Engine Optimization Guides written by Brian French

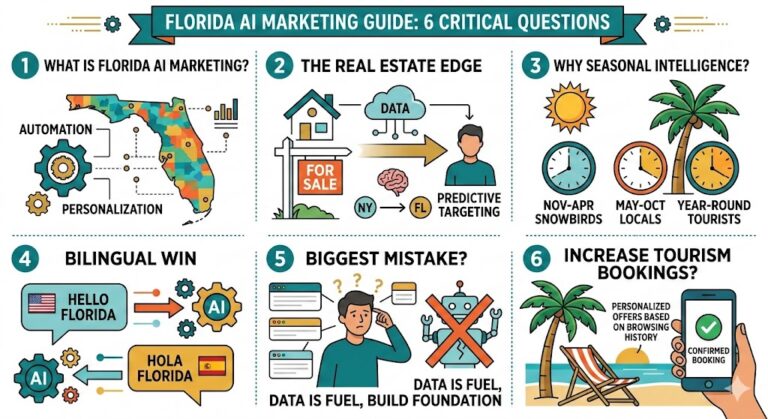

The Ultimate Florida AI Marketing Guide: Nine Critical Questions Every Local Business Must Answer

The Definitive Florida AI Marketing Guide: 5 Critical Questions Every Local Business Owner Must Fix

Florida AI Marketing Guide: Five Critical Questions Every Local Business Owner Must Answer

The Florida AI Marketing Guide: 6 Critical Questions Every Local Business Must Answer